1:00 - Nut cuttin Time!

12:40 - Decoupling Is Back After Plunging 10 Year Yields Reflect 10 Point ES Disconnect

A while back I added the $ - 0 - SPX - 30 min - One Month chart. The disconnect is obvious, but not something that is a must. Whether the AUD/JPY, ERU/USD, the USD or the TNX - whatever is the hot ticket du jour the market will follow it or relate to it like a blind puppy.

11: 51 - Boredom - so watch this and freak out later.

10:15 - follow the blue dashed diagonal. Nailed it and reversed like clockwork. 50% retracement from the 56 low and nailed the 89 support area. Still digesting what the fuck is going on here.

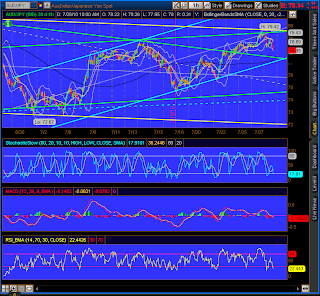

10:00 - DOW chart - Spiking thru the 60m BB's on top and bottom. Can't get momo in either direction. All the lines in this chart are pretty solid I think, so you have a bunch of support points and resistance as well. Sum bitch won't move for some reason.

Here is a little different look at the minis from my home computer on a daily basis. the wedge is real clear and the indicators are toppy and are actually following SPX's lead right now lagging somewhat.The two gold lines are the massive P2 wedge playing out. Can't wait to see what happens at that apex.Minis are down 6+ at midnight and resting on that lower TL if it cracks the shorties may be in business. If EWT is right we'll be in a nasty 3rd wave down then. I like the way the markets are setting up for the 3 to play out. I'll say we may still be a bit early for the big nasty.

Not commenting on anything till all the econ indicators report. I'll say that you need to have your finger on the trigger willing to shoot either way. I assume down will be the appropriate direction. We now know that it was this announcement Already Bought A 3D LCD In Anticipation Of QE "Instarefi" 1.999? You May Want To Consider A Refund that moved or reversed the markets from what should have been a free fall. I updated a bunch of charts. That reversal today really screwed up the ST charts indicators. I'll say I do like the ring that "Flash Friday" has to it. GL!

Economic Calendar -

8:30 GDP - Can you spot the government stimulus in the blow chart? Can you spot the absence of it?

9:45 Chicago PMI -

9:55 - Consumer Sentiment - Will it be another stunner? The markets may wait on this number to really get moving.